The tax system can help your business succeed, Mark Chapman from H&R Block reports.

For any small business, standing out from your competitors can be the key to success. After all, there are plenty of plumbing businesses out there. So having one or more “Unique Selling Points” can make all the difference in attracting and keeping customers. That’s where being innovative with your products or service offering can help your stand out. The problem is that being innovative usually involves immediate financial investment for longer term financial gain. Is there anything the taxman can do to help?

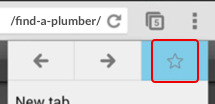

Get a website

Having a website, or an app, may not seem particularly innovative in this day and age but recent research shows that 50% of Australian small businesses still don’t have a website. Those that don’t are losing business with 62% of potential customers saying they will stop considering a business if they can’t find information online.

So, if your business still doesn’t have a web presence, now is the time to fix that and take advantage of the tax breaks available.

The most significant of those is the $20,000 instant asset write-off that allows businesses with a turnover up to $10 million to immediately write off the cost of capital assets costing up to $20,000 per item. The government recently announced that this tax break would be extended through to 30 June 2019 and it potentially allows your business to immediately write off against profit the costs of building a website expenditure such as:

- the software that allows the website to operate, typically including interactive functions, e-commerce tools, membership or “sign-in” functions.

- Dedicated hardware (server, CPU and other physical assets).

- Wages or contractor fees paid to IT professionals to help design and build the website.

Costs dedicated to maintaining the website, and expenses associated with uploading content, for example price lists, stock lists, text or pictures, are generally treated as operating costs incurred in the ordinary course of business. These types of costs are usually deductible in the same year that they are incurred. The hosting of a website would also typically be treated this way as this is part of the regular ongoing cost of operating the business.

Get your plant and equipment up to date

The same tax break can also be used to immediately write-off the cost of purchasing the latest tools, plant and equipment for use in your business. Provided the cost of each item is less than $20,000 you can get a tax break for items like drain cleaners, pipe threaders, hydro jets and pressure sensors, to name just a few.

H&R Block’s advice is for general use. Always seek tailored information to suit your circumstances.

Share this Article