Despite ongoing uncertainty from new COVID strains, we’ve seen the last six months produce strong investment returns.

2021 ended with the discovery of Omicron, a new COVID strain. This sent shockwaves through financial markets as they responded to renewed uncertainty. COVID itself and any new strains will continue to pose a risk to global growth and recovery. But, as the world adapts to living with the virus, thankfully each new wave has had a smaller impact on the economy and on financial markets.

Despite the potential for short-term disruption and ongoing risk from the pandemic, the global economy is expected to continue growing strongly in 2022. Economic activity should be supported by further reopening of international travel, households building a larger amount of savings during the pandemic, rising house prices and share markets.

However, this strong growth is starting to create additional inflation pressures, something that has been made worse by pandemic-related disruptions to supply chains and extremely high demand for household goods. The combination of strong growth and higher inflation has seen most central banks around the world begin to remove some of the emergency stimulus programmes that have been in place.

Higher interest rates and strong economic growth should provide a positive environment for global share markets, although we are likely to see increased volatility and more modest overall increases. But should high inflation force central banks to tighten policy more aggressively, for example through raising interest rates, then markets could be in for a trickier time in 2022.

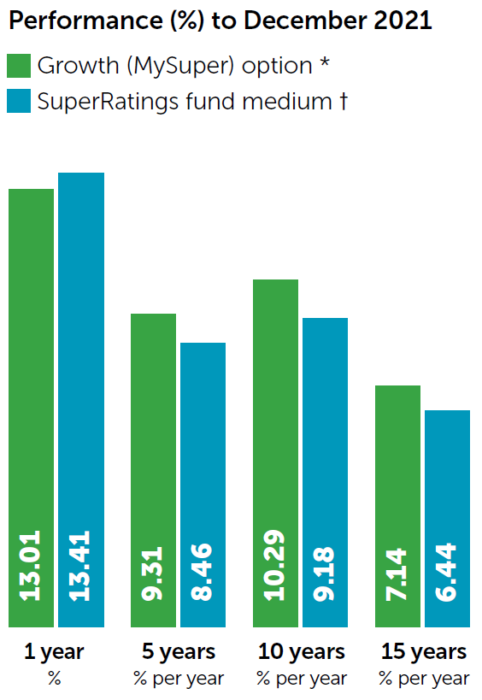

Our Growth (MySuper) option delivered a 13.01%* return for our members for the twelve months through to December 2021.

Returns across 5, 10 and 15 years have outperformed the industry average, which is why it’s important to focus on the long-term nature of super.

Past performance is not a reliable indicator of future performance.

*The return for the Growth (MySuper) option is based on the crediting rate, which is returns minus investment fees, taxes and until 31 January 2020, the percentage-based administration fee. Excludes fees and costs that are deducted directly from members’ accounts.

† The average median return is taken from the SuperRatings Balanced (60-76) survey (December 2021). SuperRatings is a ratings agency that collects information from super funds to enable performance comparisons - visit superratings.com.au

This information is about Cbus. It doesn’t take into account your specific needs, so you should look at your own financial position, objectives and requirements before making any financial decisions. Read the relevant Cbus Product Disclosure Statement to decide whether Cbus is right for you. Also read the Target Market Determination at cbussuper.com.au/tmd. Call 1300 361 784 or visit cbussuper.com.au for a copy.

Share this Article